crypto tax calculator nz

Inland Revenue has recently given an update on its thinking on how Bitcoin and other cryptocurrencies should be dealt with from a tax perspective. Before you can put your cryptoasset net income or loss in your tax return you need to.

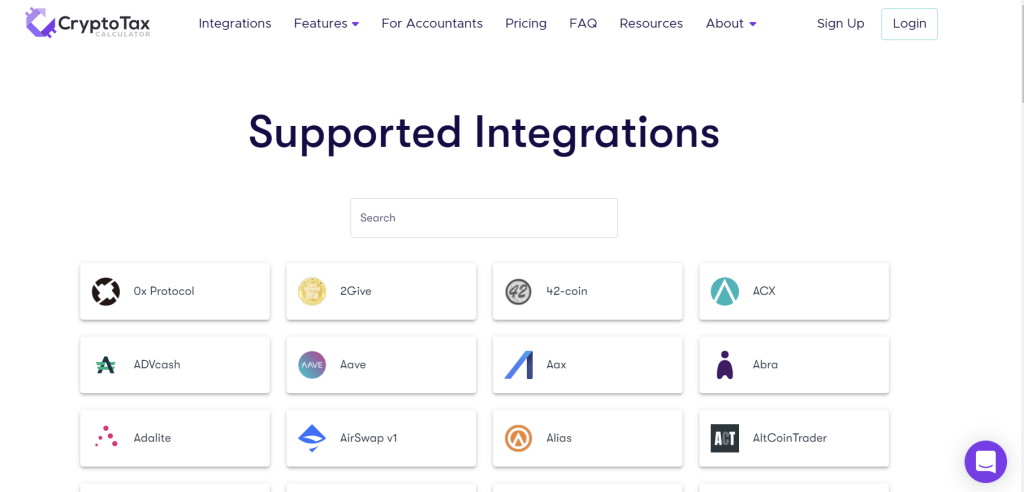

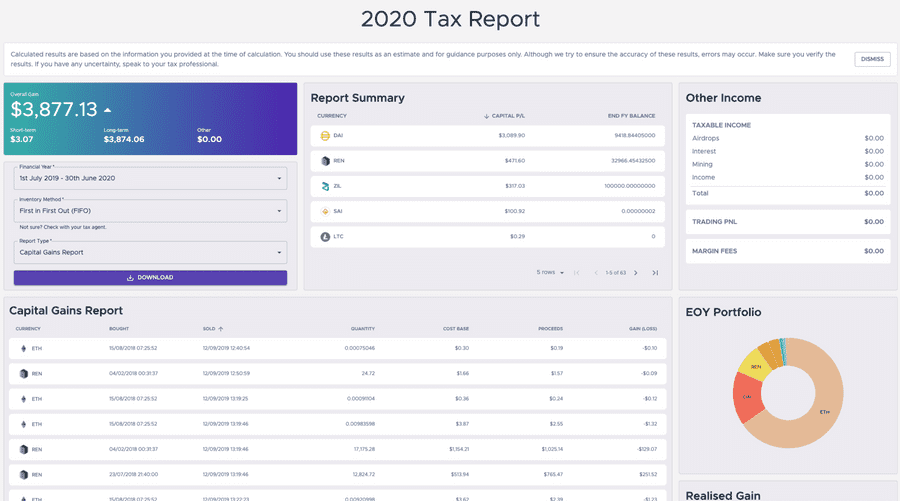

Crypto Tax Calculator 2021 Platform Review

Check out this table to know how to calculate your taxes.

. Cryptoassets and tax residence. The IRD has now published guidance to explain how New Zealands existing tax laws should be applied to bitcoin and other cryptocurrencies. If you are an accountant you can also work with the Crypto Tax Calculator for 499year.

Without knowing an individuals total income from all sources we cannot calculate how much tax there is to pay because it depends on the individuals total income. Take the initial investment amount lets assume it is 1000. When you exchange the BTC for ETH disposal of the BTC happens and you need to calculate the price difference of the BTC in NZD between when you bought it with NZD and.

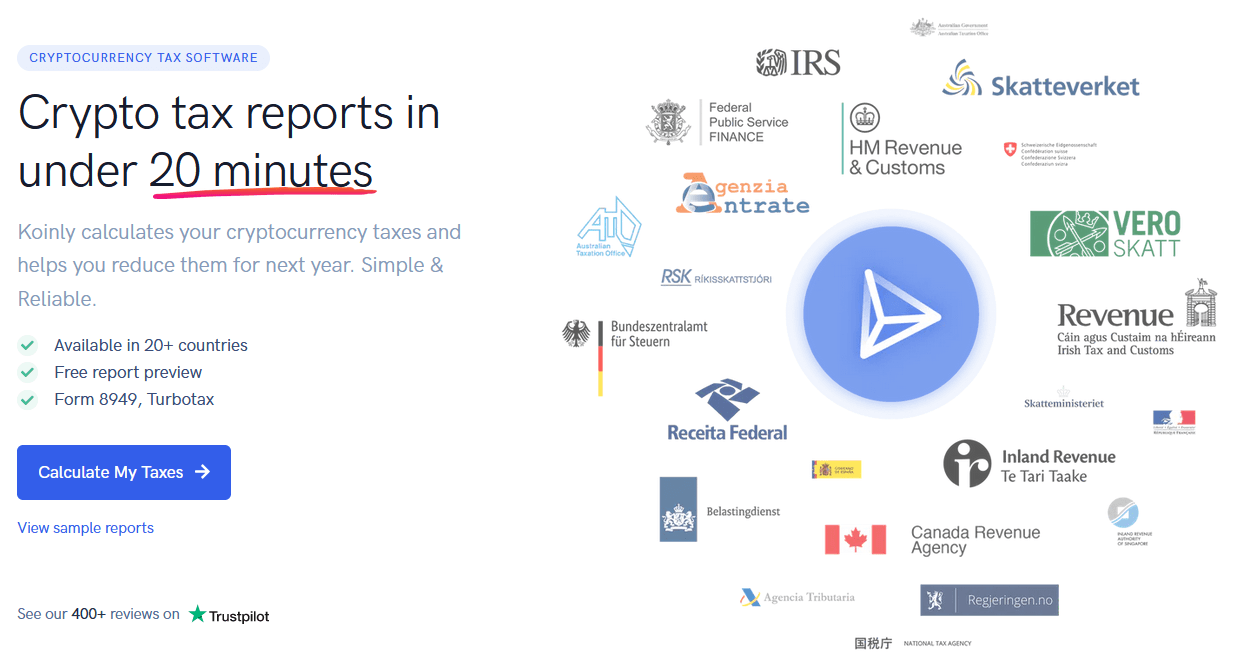

A If you are a tax resident. Koinly can generate the right crypto tax reports for you. Coinpanda lets New Zealanders calculate their capital gains with ease.

If the result is a capital loss. File your crypto taxes in New. Now that your account has funds in it you are free to purchase any type of cryptocurrency.

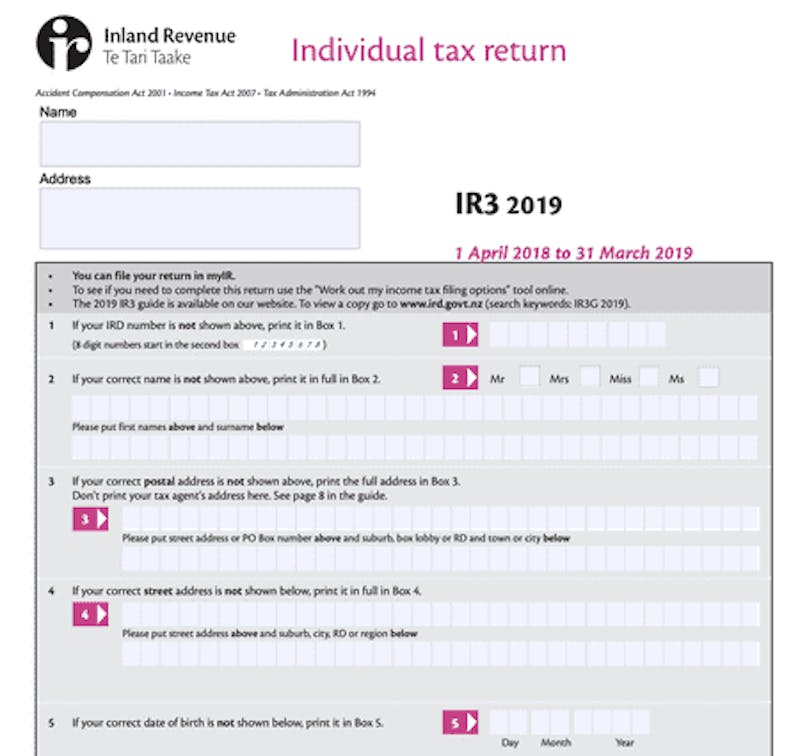

Go to the buy section select the cryptocurrency you want to trade. Taxoshi NZs Crypto Tax Caluclator. Calculate the New Zealand dollar value of your cryptoasset transactions.

Heres an example of how to calculate the cost basis of your cryptocurrency. All plans have a 30. Selling crypto for fiat eg NZD is a taxable event examples below Trading one coin for another is a.

If youre converting between crypto and non NZD currencies you cannot use the apps NZD converter as it probably wont be the same as conversion rates released by the IRD for the tax. Work out your cryptoasset income and expenses. Download your tax documents.

Straightforward UI which you get your crypto taxes done in seconds at no. This means you can get your books. Divide the initial investment amount.

The tax treatment of crypto assets first became a hot issue in 2016 when the price of bitcoin rose from US500 to US1200 and continued to climb strongly to almost US20000. Receiving mining or staking. Whether you are filing yourself using a tax software like TurboTax or working with an accountant.

For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in. You need to use amounts in New Zealand dollars NZD when filing your income tax return. Check out our free guide on crypto taxes in New Zealand.

You need to file a tax return when you have taxable income from your cryptoasset activity. Taxoshi is a cryptocurrency tax calculator focused on helping kiwis understand their tax position. This new rate applies from 1st April.

The platform offers you ten clients and up to 100000 transactions per client. Some cryptoasset transactions may not have an NZD value such as. Subtract the basis or the price you bought the crypto for plus any fees you paid to see it.

Founded by the mighty Craig MacGregor co-founder of Navcoin and a legend in the NZ Crypto scene Taxoshi is a homegrown tax. The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

This information is current. The amount of tax you need to pay depends on how much income you have. Generate ready-to-file tax forms including tax reports for Forks Mining Staking.

Koinly helps New Zealanders calculate their income from crypto trading Mining Staking Airdrops Forks etc. You simply import all your transaction history and export your report. Our step by step wizard and cryptocurrency tax calculator is fine-tuned for New Zealand and.

The tax rate on this particular bracket is 325. Buying crypto is not a taxable event see example 2 below. Multiply the sale price by how much of the coin you sold.

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Crypto Tax Calculator 2021 Platform Review

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Cryptocurrency Taxes What To Know For 2021 Money

Koinly Review And Alternatives Is It The Best Crypto Listy

5 Best Crypto Tax Software Accounting Calculators 2022

Crypto Tax Calculator Review June 2022 Finder Com

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Earn More Money Free Money

Koinly Crypto Tax Calculator For Australia Nz

3 Steps To Calculate Coinbase Taxes 2022 Updated

Capital Gains Tax Calculator Ey Us

Crypto Tax Calculator 2021 Platform Review

Crypto Tax Calculator Review June 2022 Finder Com

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Best Crypto Tax Software Top Solutions For 2022

Crypto Tax Calculator 2021 Platform Review

Crypto Tax Calculator 2021 Platform Review

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe